How To Calculate A Partnerships Inside Basis

Solved the partners share the profits of the partnership in A,b and c were partners sharing profit and losses in the proportion of Solved when the partnership contract does not specify the

Important questions of fundamentals of partnership - Class 12

Solved compute the adjusted basis of each partner's Partnerships: how to calculate partner basis Partnership basis calculation worksheet

Solved 7. how does accounting for a partnership differ from

Partnership formulas, tricks with examplesSolved partnership income allocation-various options the How to calculate outside basis in partnership?Answered: 4. a and b formed a partnership. the….

Comprehensive taxation topics cch federal chapter accounting tax partnership basic partnerships exchanges distributions sales basis outside ppt powerpoint presentationSolved question # 03 a and b are partners in a partnership Partnership basis interest calculationTax equity structures in u.s. – dro’s, stop loss, outside capital.

Partnership formulas and tricks for bank exams and ssc cgl exam

Partnership basis calculation worksheetWhat increases or decreases basis in a partnership? Partnership formulas edudose investment equivalent divided profit ratio loss monthly different then their mathsSolved question 8 a partner's basis in a partnership is.

Webinar partnerships calculate basis partner taxation28+ partnership basis calculation Solved partnership income allocation-various options theSolved the partners profit and loss sharing ratio is 23:5,.

Partnership definition

Solved 15. the difference between a partnership and aWebinar 0005: partnerships: how to calculate the partner’s basis Solved 2. partnership-calculation and distribution ofSolved if the partnership agreement does not specify how.

Solved 4) accounting for partner contributions, allocatingCalculating adjusted tax basis in a partnership or llc: understanding Solved 1. a partnership comprised of two partners has theImportant questions of fundamentals of partnership.

Chapter 10, part 2

Solved partnership income allocation-various options thePartnership basis calculation worksheet Outside tax capital account basis accounts structures equity loss stop partnership dro accountingPartnership formulas, tricks with examples.

Partnership formulas edudose 27x 14xPartnership organizational chart – a detailed guide .

Solved Partnership Income Allocation-Various Options The | Chegg.com

Webinar 0005: Partnerships: How to Calculate the Partner’s Basis | CPE

Partnership Basis Calculation Worksheet - Studying Worksheets

Important questions of fundamentals of partnership - Class 12

Partnership Formulas and Tricks for Bank Exams and SSC CGL Exam

Solved Question 8 A partner's basis in a partnership is | Chegg.com

Solved The partners share the profits of the partnership in | Chegg.com

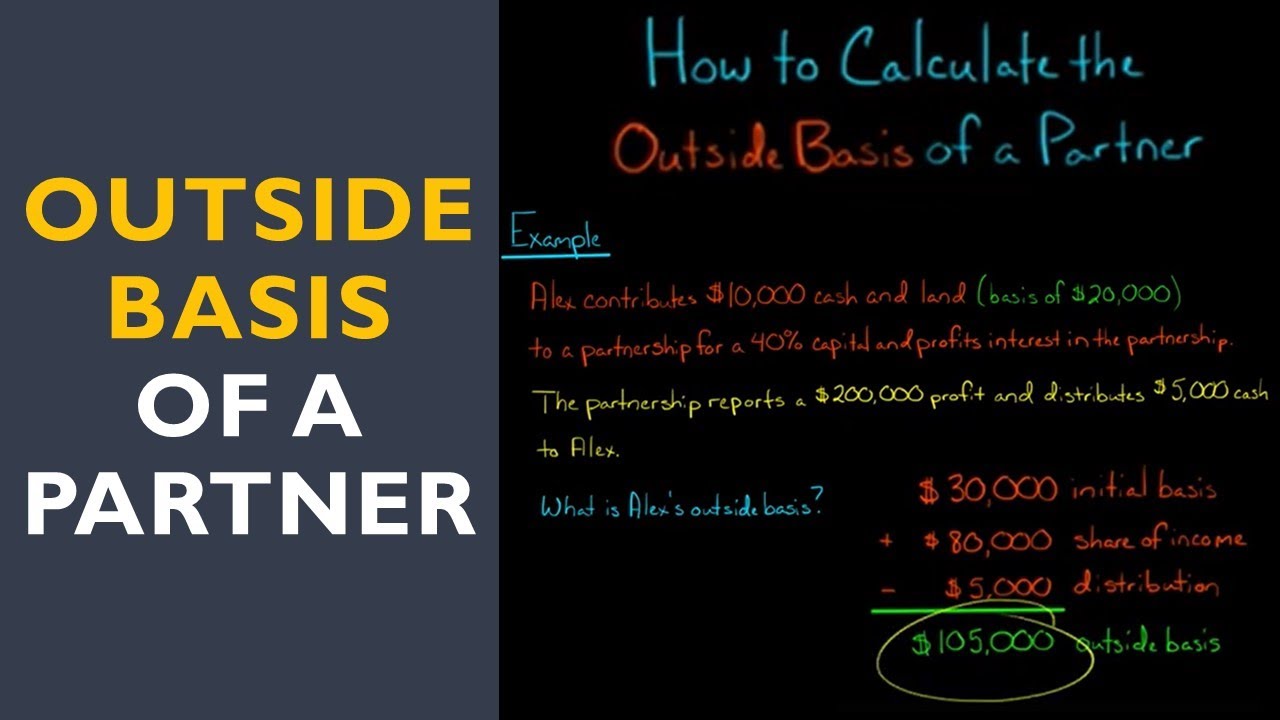

How To Calculate Outside Basis In Partnership? - The Mumpreneur Show